|

|

| Option Calculators and Stock Screeners |

|

|

|

|

|

|

The 52 Week High/Low Volatility Screener identifies options with implied volatility at a 52 week high or a 52 week low.

Stocks will often have unusually high volatility just prior to the

payout of a dividend. It can sometimes be profitable to sell options

for the high premiums when this occurs, then buy the options back when

the volatility subsides.

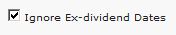

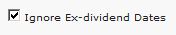

These high volatility dates can be filtered out of the screen results

by selecting the 'Ignore Ex-dividend Dates' checkbox. When this

checkbox is checked, highs or lows in implied volatility that occur on

the days preceding an ex-dividend date are ignored.

|

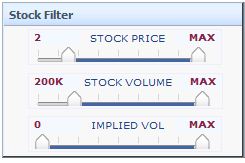

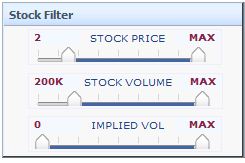

Stocks can be filtered by price, volume, and implied volatility.

- Price Range - set the sliders to the minimim and maximum prices. Only stocks with a price between the minimum and maximum prices will be included in the screen.

- Stock Volume - Only stocks with a daily volume between the minimum and maximum volume will be included in the screen.

- Implied Volatility - only show stocks with an implied volatility in the selected range

|

| *Tip: A slider can be moved by clicking anywhere on the

slider bar. |

|

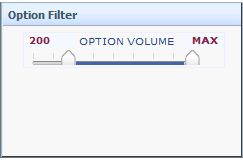

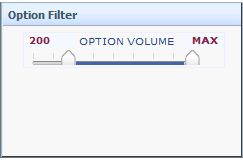

Stocks can be filtered by total Option Volume.

-

Option Volume - set the sliders to the minimum and maximum total

volume of all contracts on the high/low date. Only stocks with total

option volume in the selected range on the high/low date will be

included in the screen.

|

*Tip: Click the chart button  to show the spread in the Strategy Calculator.

to show the spread in the Strategy Calculator. |

|

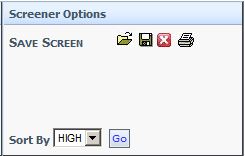

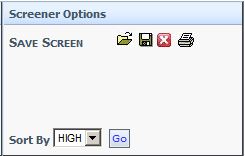

- Saving a Screen - Subscribers can save screen parameters and recall

these parameters later. Screener type, slider values, and sort order parameters are saved. The date of the screen is

not saved. When a saved screen is opened, the parameters will be applied to

the currently selected date.

-

Sort By - the order in which the screener results are displayed. The

results may also be sorted by clicking on column headers. Sorting by

clicking on column headers only sorts the data that is already in the

report.

- HIGH - List stocks that have recently hit their 52 week implied volatility high.

- LOW - List stocks that have recently hit their 52 week implied volatility low.

|

- Stock - the underlying stock symbol

- Stock Name - the underlying stock name

- High/Low Date - the date that the high or low volatility occured

- Stock Price - the underlying stock price

- Stock Volume - the underlying stock volume

- Option Volume - the sum of all underlying option volume

- Implied Volatility - Contract implied volatility.

- Price Change - the change in price on the high/low date

Data is updated nightly.

Go back to the 52 Week High/Low Volatility Screener.

|

|

|

| Data Provided by HistoricalOptionData.com |

|

open interest example

skew volatility

margin leverage

covered call options

stocks risks

option trading

stock market investing advice

stocks with best dividends

online option calculator

open interest percentage

investment portfolio analysis

leverage with options

option basics

puts and calls

trading with leverage

put call ratio indicator

high growth stock

option volume data

volume vs open interest

what is volatility skew

basics of stock trading

|

| Optionistics is not a registered investment advisor or

broker-dealer. We do not make recommendations as to particular

securities or derivative instruments, and do not advocate the

purchase or sale of any security or investment by you or any

other individual. By continuing to use this site, you agree to

read and abide by the full disclaimer.

|

|

to show the spread in the Strategy Calculator.

to show the spread in the Strategy Calculator.