Selling covered calls is a relatively simple strategy. The owner of a stock sells the right to have their stock purchased at a predetermined price in the future. If the stock price goes above the predetermined price, the buyer of the call can force the covered call seller to deliver the stock at that price.

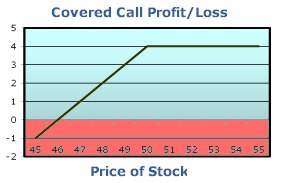

For example, you're holding a stock that's trading at $50. Instead of simply holding the stock with the hope that it goes up, you sell the call on your stock for $4. The call gives the buyer the right to buy your stock at $50 at anytime during the next month. If the stock stays above $50 the buyer of the call will call away your stock at $50. You give up the stock, but keep the $4. If the stock drops below $50, the rights to buy your stock at $50 are worthless, since the stock can be purchased in the open market for less than $50. You still get to keep the $4, however, you incur the loss on the stock since the price dropped. The overall position is still profitable as long as the stock does not drop by more than $4.

The objective of the covered call writer is to collect a high premium, since the premium represents both the potential profit and the protection against a drop in the stock price.

At Optionistics, the highest paying calls are identified daily.

| Related Links | ||||

|---|---|---|---|---|

| Covered Calls | Covered Puts | Reading The Reports | More on Covered Calls | Covered Calls Tutorial |

The seller of a covered call must buy the stock which can be expensive. Consider selling the uncovered put instead. The example above is illustrated in the chart to the right. The $50 at the money put and call both sell for $4, which the seller collects at the time of option sale. If the stock rises above $50 the put becomes worthless and the seller of the put keeps the $4. The put seller is subject to loss as the stock drops, but the position remains profitable as long as the stock does not drop more than $4 below the strike, just like the covered call.

Many investors are limited to selling covered calls in certain accounts by their brokers, including most retirement accounts. Some brokers permit the sale of uncovered puts in retirement accounts, provided there is enough cash remaining in the account to cover the loss if the stock should fall. The cash required to sell the put is equivalent to the cash required to purchase the stock, less the proceeds from the sale of the call. These cash covered puts offer a number of advantages.

Unlike the covered call seller, the uncovered put seller does not have to hand over the money to buy the stock, and interest is collected on the credit balance that remains in the account. The put seller needs to execute one trade instead of two, thereby reducing commissions and the overhead of the spread. The positon is easier to enter into and, more importantly, easier to get out of. The put seller is not entitled to a dividend, but puts on stocks that pay dividends are more expensive, and therefore return more to the seller, since the stock price will predictably drop when the stock goes ex-dividend.

An Alternative to Covered Calls

| Related Links |

|---|

| Straddle Screener |

| Reading The Straddle Report |

| Straddle By $$ |

| More on Straddles |

| Straddles Tutorial |

If the objective of covered call writing is to collect the call premium, consider collecting twice the premium. Selling both the call and the put will generate approximately twice the return. The potential for profit will be double, and the amount of protection against a change in the stock price will also double. A covered call writer loses only if the stock falls, but the straddle writer runs the risk of losing if the stock rises or falls.

At Optionistics, high paying Straddles are identified each day. Two Straddles reports available, the Straddle Screener shows straddles comprised of option legs that have the highest volatility, and the Straddles by Dollars report shows the Straddles that generate the highest return as a percentage of the underlying stock.