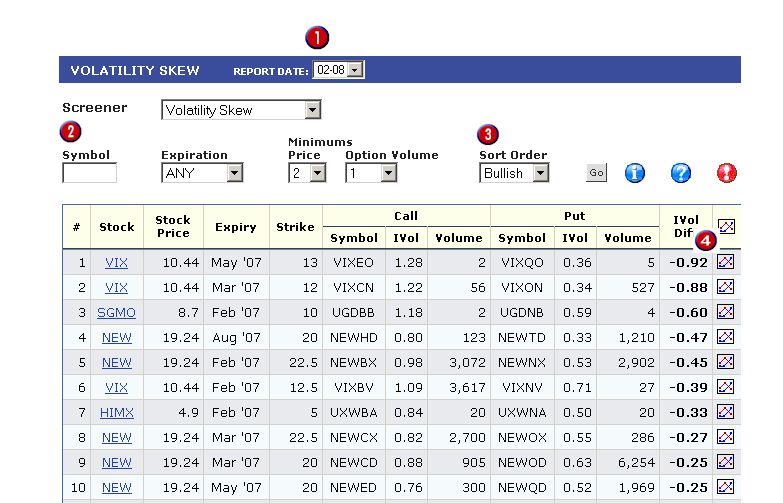

Finding Volatility Skew

The

Volatility Skew Finder

can be used to identify stocks with call contracts trading at higher volatilities

than similar put contracts, or put contracts trading at higher volatilities than

similar call contracts.

- Choose the desired Report Date from the Report Date drop down menu. Subscribers

can generate reports using end of day trading data from the most recent

trading day. Non-subscribers must register to use the report and will see

delayed data.

- Optionally, enter a symbol, expiration, minimum price, or minimum option

volume. All filter criteria is applied to both Call and Put contracts.

- Choose a Sort Order. The 'Bullish' option shows contracts that have a

higher Call implied volatility than Put implied volatility. The 'Bearish' option shows contracts

that have a Put implied volatility higher than the corresponding Call

implied volatility. The difference

is displayed in the IVol Diff column.

- Click on the chart icon

to display the Volatility Skew chart for the corresponding stock.

to display the Volatility Skew chart for the corresponding stock.

to display the Volatility Skew chart for the corresponding stock.

to display the Volatility Skew chart for the corresponding stock.