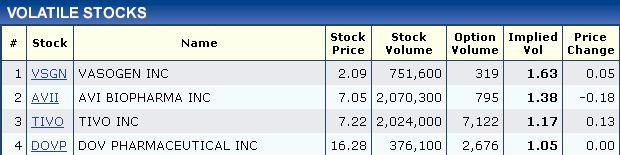

Volatile Stocks

|

The first step to profitable trading is finding stocks that are likely to move. |

Changes in option activity, open interest, and stock and option volume are all precursors to changes in stock prices. The most significant indicator of a potential price change is the stock's volatility. One way to represent a stock's volatility is to measure historical price changes. If a stock's price has fluctuated a lot in the past, it is theoretically likely to fluctuate in the future. Historical analysis can reveal a lot about past activity, but it is not necessarily an indicator of future price changes. A very effective method of measuring a stock's volatility is to examine the underlying option prices and imply the volatility from the relative price of the options. Expensive options indicate a greater likelihood that a stock will move.

At Optionistics, we analyze thousands of option contracts and determine which options are unusually expensive. We use a proprietary algorithm to aggregate the volatility of selected options, then rank the underlying stocks by how likely they are to move. The Volatile Stocks report is updated each trading day.

| Full Report |

|

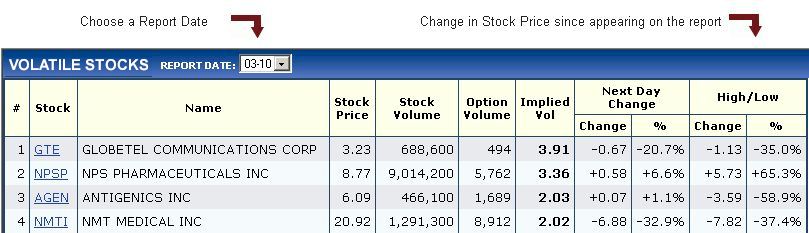

Past Performance

How well does this algorithm work? The performance of stocks that appeared on past Volatile Stocks reports is available for up to 30 days, depending on the subscription level. Check out the performance of the Volatile Stocks by selecting a Report Date from the drop down menu below to see past Volatile Stocks reports and see how those stocks performed.

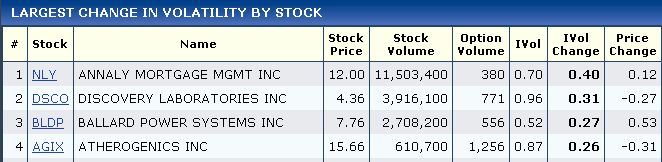

Some stocks consistently have expensive options, but the price of some stock's options may jump in response to news, earnings, or other events. Stocks that have an abrupt rise or fall in volatility are identified in the Volatility Change report. A drop in volatility may precede a period of inactivity in a stock, and may signal the time to close a position.

| Full Report |

|

More comprehensive Volatile Stocks reports which includes the ability to filter by stock volume and stock price are available here. The Volatile Stocks and Volatility Change reports are summarized on the Daily Hot Sheet. Subscribers get all Volatility reports without delay.

|

After identifying the stocks that are likely to move, go to Step 2: Find the Likely Direction. |