|

|

| Option Calculators and Stock Screeners |

|

|

|

|

|

|

The Option Screener lists complex option trades that consist of two

option legs.

Both legs of Bull Calls, Bear Puts, Bull Puts, Bear Calls, Calendar, and Diagonal

spreads are either puts or calls, and one leg is long while the other is short.

Straddles and Strangles consist of one call leg and one put leg, and both are long

or both are short.

The Option Screener offers numerous methods for screening option spreads:

|

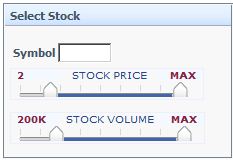

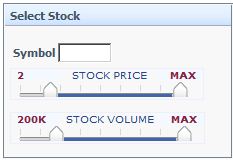

Stocks can be filtered by price and volume.

- Symbol - Optionally enter a stock symbol to limit the screen to spreads on the underlying stock.

- Price Range - set the sliders to the minimim and maximum prices. Only stocks with a price between the minimum and maximum prices will be included in the screen.

- Stock Volume - Only stocks with a daily volume between the minimum and maximum volume will be included in the screen.

|

| *Tip: A slider can be moved by clicking anywhere on the

slider bar. |

|

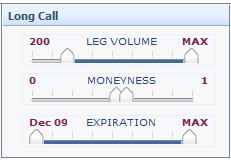

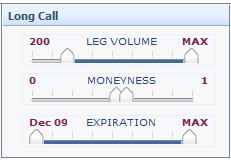

Options can be filtered by Volume, Moneyness and Expiration

- Leg Volume - set the sliders to the minimim and maximum volume of the long contract. If

only one volume slider is available for an option it will apply to all the options in the spread.

- Moneyness - refers to the number of strikes an option is in or out of the money.

Options with a moneyness of zero are At The Money (ATM). Strike prices

increase as the moneyness becomes more positive. Strike prices decrease as the

moneyness becomes more negative. For call spreads, a positive number is Out of The Money (OTM).

Negative numbers are In The Money (ITM). For put spreads, a positive number is

In The Money (ITM) and negative numbers are Out of The Money (OTM). See Moneyness.

- Expiration - include only options that expire between the start of the

earlier month and the end of the later month. Options expiring on any date in

the selected months may be included in the screen, including weekly options,

quarterly options, and options that expire on odd days (e.g. VIX options).

Both expiration sliders may be set in the same month. All options expiring in

the selected month will be considered in the screen.

|

| *Tip: Subscribers can save reports. |

|

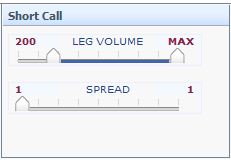

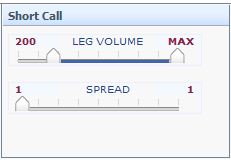

- Leg Volume - the minimim and maximum volume of the short contract.

- Spread - the number of strikes away from the long leg. For example,

a Bull Call on a stock with $95, $100, and $105 strikes that has a

long leg of $100 and a spread of 1 will have $105 short leg. The $105

strike is 1 strike away from $100. To get a call spread with a $100

long leg and a $95 short leg, select Bear Calls.

|

*Tip: Click the chart button  to show the spread in the Strategy Calculator.

to show the spread in the Strategy Calculator. |

|

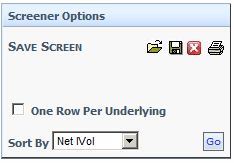

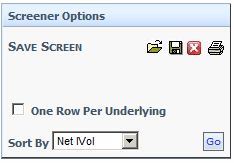

- Saving a Screen - Subscribers can save screen parameters and recall

these parameters later. Screener type, slider values, symbol, sort order, and

"One Row Per underlying' parameters are saved. The date of the screen is

not saved. When a saved screen is opened, the parameters will be applied to

the currently selected date.

- One Row Per Underlying - Show only the first occurence of an option for

underlying stock.

- Sort By - the order in which the screener results are displayed. Up to 100

rows are included in each screen. The results may be sorted by clicking on

column headers. Sorting by clicking on column headers only sorts the data that

is already in the report.

- NetIVol - the difference in the volatility of the two legs weighted by the maximum profit.

- Net Debit/Credit - the maximum profit, without regard to the volatility.

- ROI - return on investment if a covered position is called. ROI is only

available for the Expensive Calls screen and the Expensive Puts screen.

|

- Stock - the underlying stock symbol

- Stock Price - the underlying stock price

- Fields for both the Short and Long Leg:

- Short Expiration Date

- Long Expiration Date

- Strike

- Option Price

- Put vs. Call

- Credit or Debit - the net cost or net proceeds from the trade of the spread, i.e. the price of the short leg minus the price of the long leg

- Spread - the difference between the strike prices

- Spread Ratio - the ratio of the spread to the Credit or Debit. This is a

measure of the maximum profit versus the maximum loss.

- Net IVol - Net implied volatility; the difference in the implied volatility of the two option contracts

Excluded Contracts

Contracts that have any one of the following conditions are excluded:

- no bid

- no volume

- no open interest

- no contracts in the cycle. See Option Cycles.

Data is updated nightly.

|

|

|

| Data Provided by HistoricalOptionData.com |

|

strike price stock options

butterfly spread graph

iron condor options

covered call writing

stock price calculator

most volatile stocks

what is option open interest

butterfly spread

options calculator

the stock market today

options iron condor

what is dividend yield

stock trading

historical option prices

iron condor example

leverage stock market

high option volume

stock market basics

the stock market today

dividend yielding stocks

|

| Optionistics is not a registered investment advisor or

broker-dealer. We do not make recommendations as to particular

securities or derivative instruments, and do not advocate the

purchase or sale of any security or investment by you or any

other individual. By continuing to use this site, you agree to

read and abide by the full disclaimer.

|

|

to show the spread in the Strategy Calculator.

to show the spread in the Strategy Calculator.